Dental Practice Financial Management: Expert Tips Inside!

Imagine this: your chairs are full, your staff is busy, and patients are walking through the door—but at the end of the month, your profits don’t reflect the hustle. Sound familiar? You’re not alone. Many dental practices unknowingly leak revenue through inefficient budgeting, unchecked expenses, outdated supplier contracts, or a lack of financial visibility.

In this article, we’ll dive into the financial foundations every dental practice should prioritize. From understanding the importance of regular cash flow analysis and crafting a sustainable budget to optimizing overhead, upgrading software solutions, and leveraging revenue-boosting strategies like service diversification, these practical insights are designed to help your practice run smarter, not harder.

Whether you’re just starting out or managing a multi-location clinic, getting your finances right is what turns a busy practice into a profitable one. Let’s explore how you can take control, gain clarity, and build a practice that thrives—financially and operationally.

What is Dental Practice Financial Management?

Managing finances is often not prioritized by dentists; however, it’s incredibly important for the long-term success of any dental practice. Dental Practice Financial Management is not simply about paying the bills and staff salaries but involves a meticulous approach to understanding and managing cash flow, expenses, revenues, and financial planning for the future.

Proper financial management aids dental practices in their ambitions to yield more profits and achieve consistent growth. As a dentist or a practice owner, it is vital to take into consideration the cost management strategies, revenue enhancement methods, financial reporting, and analysis to stay at the top of your game.

The goal is to maintain the financial health of your business while continuing to provide quality dental care services. Let’s dive deeper into the essentials you need to know to master dental practice financial management.

How to Understand Your Cash Flow?

Cash flow is the backbone of any dental practice as it keeps the business operational. It refers to the inflow and outflow of funds within a practice, including income from treatment options like root canals, payments made to suppliers, salaries, and overheads, among others. Gaining an insight into your cash flow helps identify trends, plan for future spending, and ensure the availability of sufficient funds for different aspects of the practice.

1. Analyzing Monthly Income and Expenditures for Effective Dental Financial Planning

Crunching numbers may not be your favorite pastime as a dentist, but it’s a necessity for financial stability. Regular analysis of your monthly income and expenditures can reveal insights that help optimize resources and improve earnings. Your monthly income may constitute payments from insurers, patient fees, and income from other services, while expenditures could include payment for supplies, staff salaries, utility bills, rent, equipment upkeep, and promotional activities.

| Monthly Income Streams | Monthly Expenditures |

|---|---|

| Patient payments | Supplier costs |

| Insurance reimbursements | Staff salaries and benefits |

| Income from additional services | Rent or mortgage repayments |

| Utility bills: electricity, water, internet, etc. | |

| Equipment installation, maintenance, and replacement |

By monitoring these regularly, you can keep a pulse on your business operations and ensure that your practice remains profitable.

2. Identifying Sudden Changes in Dental Finances

Just as detecting sudden changes in a patient’s health is crucial, so is identifying shifts in your practice’s financial stability, including aspects of retirement planning. Any notable increases in expenditures or drops in revenues need to be addressed promptly to restrict possible impacts on the overall financial health of your practice.

Regular audits will help detect these changes, enabling you to design mitigation strategies effectively. Easy-to-use software solutions allow dentists to manage their finances effectively, even without tapping into accounting expertise.

How to Manage the Dental Practice Budget Efficiently?

A well-structured budget guides you towards financial security by mapping your revenues against expenditures. It keeps you on track with your financial goals and helps you allocate resources appropriately.

1. Setting Up a Functional Budget

A functional budget acts as a financial roadmap, guiding you to manage your funds wisely. Start by laying out your expected income, which would include payments from patients, service fees, insurance claims, and incidental services. Following this, delineate your fixed costs – rent or mortgage payments, insurances, wages, and supplier contracts. Then list all the variable costs like utilities, promotional expenditures, random patient supplies, office supplies, professional development, and maintenance costs.

It is important to prioritize these areas while setting up a budget, ensuring that the crucial aspects are not compromised due to limited funds. Also, some provisions for unexpected expenses should be kept to prevent financial stress. Remember to review this budget monthly for necessary tweaks.

2. Long-Term Financial Planning

While handling the day-to-day financial management of your dental practice, don’t lose sight of the future. Implementing a long-term financial plan ensures the sustainability and growth of the practice in the coming years. This includes setting aside funds for equipment upgrades, expanding services, potential relocation, and retirement plans. An effective way to accomplish long-term financial goals is to set objectives, create a plan, and stay persistent with regular check-ins and adjustments.

3. Reducing Overhead Costs

Overhead costs can significantly impact the profitability of your dental practice, particularly in the context of rising interest rates. While some costs are fixed and unavoidable, others can be controlled or even reduced through strategic planning:

- Eco-friendly practices: Adopting energy-efficient equipment and systems can help reduce costs in the long run.

- Inventory management: Minimize wastage by maintaining a just-in-time inventory system and negotiating better deals with suppliers.

- Staffing optimization: Make sure your staffing levels match patient volume to avoid labor inefficiencies.

4. Optimizing Supplier Contracts

As a busy dental practice, dealing with multiple suppliers for different requirements like dental materials, equipment, software, etc., is inevitable. Regular review and renegotiation of these contracts can potentially save significant sums over time. Be open to exploring new suppliers and negotiating discounts for bulk purchases or long-term commitments.

How to Ensure Revenue Enhancement?

In accordance with controlling costs, it’s necessary to focus on enhancing revenue streams. An increased income will directly support the bottom line, facilitate growth, and offer more financial stability for your dental practice.

1. Diversifying Services Offered

Diversifying the range of services you offer not only boosts revenues but also makes your dental practice more appealing to patients. Consider adding the following services, along with flexible financing options.

- Cosmetic dentistry: Teeth whitening, veneers, and bonds are increasingly popular.

- Pediatric dentistry: Extend your services to cater to children for a complete family dental solution.

- Specialized procedures: Brush up your skills to offer complex treatments like root canals, implants, and oral surgery.

2. Implementing Upselling Strategies

In a dental practice, upselling can be as straightforward as educating your patients about better alternatives that offer long-lasting results. While discussing treatment options, highlight the benefits of premium services and explain why they may be a wise investment in the long run. However, it’s crucial to pursue ethical upselling tactics by prioritizing your patients’ needs and choices.

3. Choosing the Right Software Solutions

Today, using the right software is not a luxury but a necessity for efficient dental practice management. A suitable software solution like Practice by Numbers can simplify tracking income and expenses, generate detailed financial reports, securely store patient data, schedule appointments, and even categorize different treatments for easy reference. By automating these processes, you free up time to focus more on providing the best patient care.

4. Periodic Financial Review and Audit

Regular financial reviews and audits are vital to keep your dental practice’s financial health in check. These in-depth examinations evaluate your practice’s financial status, confirming the accuracy of financial records, ensuring compliance with financial regulations, and identifying areas of inefficiency.

| Crucial Areas for Financial Review | Description |

|---|---|

| Revenue Streams | Analyze the revenue generated from different services and products. |

| Overhead Costs | Scrutinize recurring bills, wages, rent, and other operational costs. |

| Cash Flow | Assess the inflow and outflow of cash to understand financial stability. |

| Financial Statements | Regularly review balance sheets, income statements, and cash flow statements. |

Managing a dental practice involves more than just patient care—it requires keeping a close eye on your finances and exploring various payment options, including the credit card options available, to ensure long-term success. But with so many moving parts, it can be challenging to stay on top of everything.

That’s where Practice by Numbers comes in.

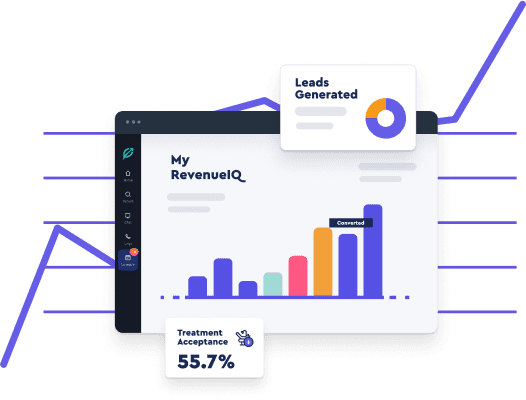

Designed with dental professionals in mind, PbN offers a comprehensive suite of tools to help you manage your practice’s finances effectively. From tracking key performance indicators to setting and monitoring financial goals, PbN provides the insights you need to make informed decisions.

What sets PbN apart?

- Comprehensive Financial Dashboards: Gain a clear view of your practice’s financial health with detailed dashboards that track revenue, expenses, and profitability.

- Goal Setting and Tracking: Set financial goals and monitor your progress in real-time, ensuring you’re always on track to meet your targets.

- Revenue Optimization Tools: Identify and capitalize on revenue opportunities with tools designed to uncover hidden income streams.

- Seamless Integration: PbN integrates with your existing practice management system, ensuring a smooth workflow and accurate data.

Having solid financial management practices in place not only ensures the financial health of your dental practice but also gives peace of mind for you as the owner. Whether it’s through seeking professional advice from lenders, investing in suitable software solutions, or adopting good financial habits, it’s never too late to start orchestrating the financial symphony that your dental practice needs and deserves.

By leveraging PbN’s tools, you can now transform your practice’s financial management.

Conclusion: Keys to Financial Success in Dental Practices

Successful dental practice financial management is a balanced act that requires meticulous planning, regular monitoring, and continuous adaptation to changes. Understanding the cash flow dynamics, creating functional budgets, prudent cost management, implementing revenue enhancement techniques, and using technology for financial duties are all crucial components. Remember to stay on top of financial reporting and analysis with periodic reviews and audits.

Having solid financial management practices in place not only ensures the financial health of your dental practice but also gives peace of mind for you as the owner. Whether it’s through seeking professional advice, investing in suitable software solutions, or adopting good financial habits, it’s never too late to start orchestrating the financial symphony that your dental practice needs and deserves.

Frequently Asked Questions

What is a good profit margin for a dental practice?

A good profit margin for a dental practice generally ranges between 25% and 35%. However, this can vary depending on factors such as practice location, size, the number of dentists, and the types of services offered.

How often should I review my financial status?

Reviewing your financial status monthly provides an up-to-date picture of your dental practice’s financial health. Regular reviews help identify trends, highlight potential issues, and enable proactive financial decision-making.